Hiring the right finance director can make or break your organization's financial health. But how do you evaluate a candidate's ability to lead financial operations, manage teams, and drive strategic initiatives? The key lies in asking the right questions during the interview process.

Essential Financial Performance Questions

Budget Management and Forecasting

When assessing a finance director candidate, understanding their experience with budget management reveals their practical expertise and leadership capabilities. The size and complexity of budgets they've handled directly correlate with their ability to manage your organization's financial resources.

Key questions to explore budget expertise:

- What size budgets have you worked with in previous positions?

- How do you approach variance analysis when actual results differ from projections?

- Describe your multi-year planning process and how you account for uncertainty

A strong finance director candidate should demonstrate experience with budgets comparable to your organization's scale. They should articulate clear methodologies for forecasting, explain how they handle budget deviations, and show understanding of long-term financial planning challenges.

Budget Experience Assessment Matrix

| Budget Size | Experience Level | Key Skills Required |

|---|---|---|

| Under $10M | Mid-level | Basic forecasting, departmental budgets |

| $10M-$100M | Senior | Advanced modeling, multi-department coordination |

| $100M-$500M | Executive | Strategic planning, investor relations |

| Over $500M | C-level | Complex modeling, regulatory compliance |

The candidate's response should include specific examples of budget challenges they've overcome and strategies they've implemented to improve forecasting accuracy. Look for evidence of continuous improvement in their budgeting processes and ability to communicate financial information to non-financial stakeholders.

• Your resume analyzed for free, opportunities delivered

Financial Reporting and Analysis

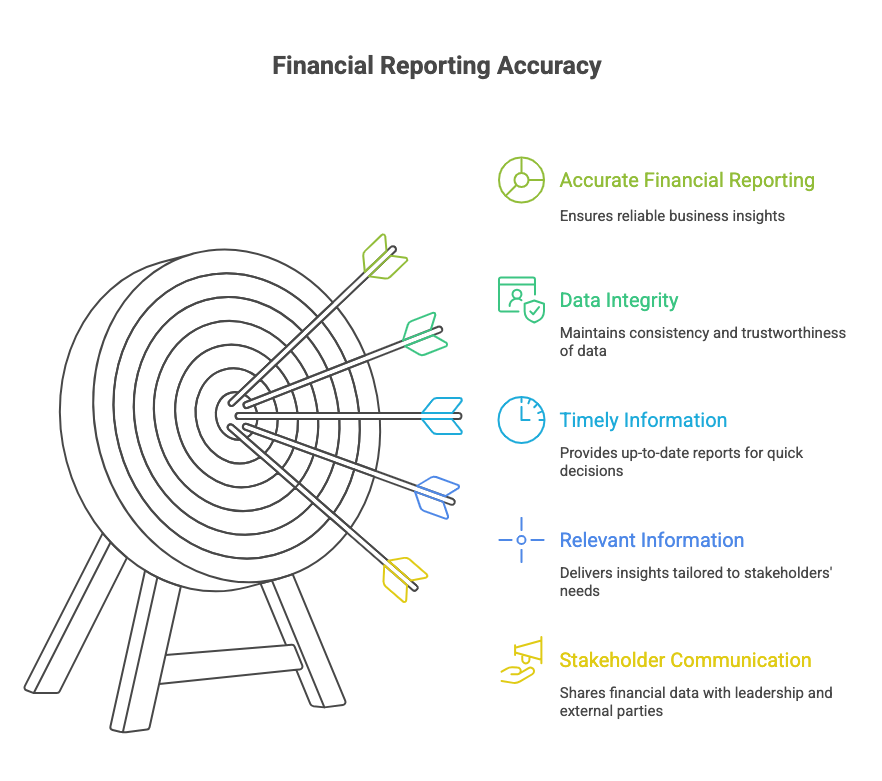

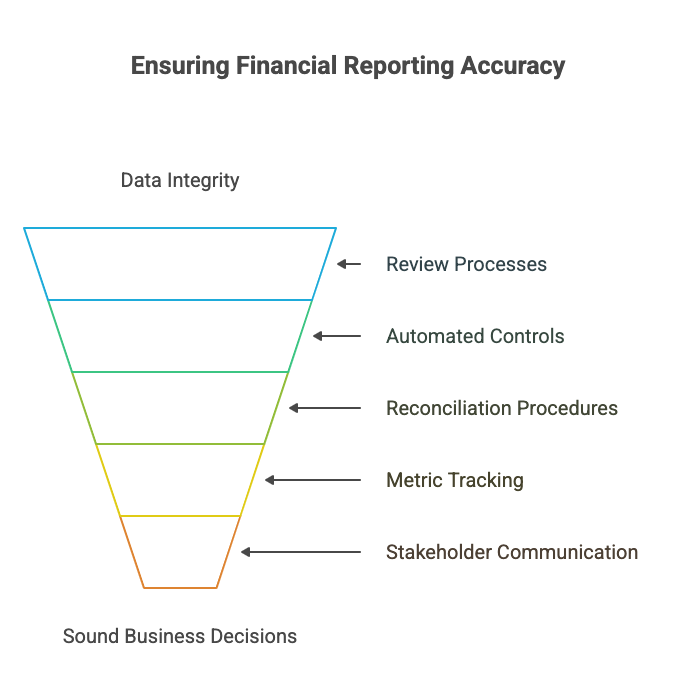

Financial reporting accuracy forms the foundation of sound business decision-making. Your finance director must ensure data integrity while providing timely, relevant information to leadership and external stakeholders.

Critical reporting questions:

- How do you ensure accuracy in financial reporting?

- What key financial metrics do you regularly track and analyze?

- Describe your experience with financial software and systems

The ideal candidate should discuss multiple layers of review processes, automated controls, and reconciliation procedures they've implemented. They should identify metrics relevant to your industry and demonstrate understanding of how these metrics drive business decisions.

Effective finance directors establish reporting schedules that balance timeliness with accuracy. They understand that different stakeholders require different levels of detail and can adapt their communication style accordingly. Their experience with financial systems should include both implementation and optimization of reporting tools.

Strategic Planning and Leadership Assessment

Vision and Strategic Initiatives

Finance directors must move beyond transactional activities to become strategic business partners. Their ability to lead initiatives that drive organizational growth distinguishes exceptional candidates from merely competent ones.

Strategic leadership evaluation:

- What key strategic initiatives have you led in your current or previous position?

- How do you align financial planning with company objectives?

- Describe your approach to long-term financial planning

Strong candidates will provide concrete examples of projects they've led, quantifying the impact on organizational performance. They should demonstrate understanding of how financial decisions support broader business strategies and show evidence of collaborative leadership across departments.

The finance director role requires balancing short-term operational needs with long-term strategic goals. Candidates should articulate how they prioritize competing demands and make decisions that support sustainable growth. Look for evidence of innovation in financial processes and systems.

Team Management and Communication

Leadership Style and Team Development Questions:

- How do you manage and develop a team of finance professionals?

- Describe your approach to communicating financial information to non-financial stakeholders

- How do you handle conflicts within your team or with other departments?

Effective finance directors build high-performing teams through clear expectations, professional development opportunities, and collaborative leadership styles. They should demonstrate ability to translate complex financial concepts into actionable insights for various audiences.

Team Leadership Evaluation Framework

| Leadership Area | Key Indicators | Assessment Questions |

|---|---|---|

| Team Development | Training programs, career advancement | How do you develop junior staff? |

| Communication | Stakeholder feedback, presentation skills | Give an example of explaining complex data |

| Conflict Resolution | Problem-solving examples, mediation skills | Describe a difficult team situation |

| Performance Management | Goal setting, feedback processes | How do you ensure team accountability? |

The candidate should provide specific examples of team members they've developed and promoted. They should demonstrate emotional intelligence in managing diverse personalities and show evidence of creating positive team culture while maintaining high performance standards.

Risk Management and Compliance Questions

Financial Risk Assessment

Risk management capabilities separate competent finance directors from exceptional ones. In today's volatile business environment, the ability to identify, assess, and mitigate financial risks protects organizational stability and enables confident decision-making.

Risk evaluation questions:

- Describe a time when you identified a financial risk and how you mitigated it

- What is your approach to financial risk management?

- How do you ensure the financial health of the company?

Candidates should demonstrate systematic approaches to risk identification, including both internal operational risks and external market factors. They should provide examples of proactive risk management that prevented significant losses or enabled the organization to capitalize on opportunities others missed.

The ideal response includes discussion of risk assessment frameworks, scenario planning processes, and collaboration with other departments to understand operational risks. Look for evidence of balancing risk mitigation with business growth objectives.

Regulatory Compliance

Compliance requirements continue expanding across industries, making regulatory expertise increasingly critical for finance directors. Their knowledge must span current regulations and demonstrate adaptability to future changes.

Compliance assessment areas:

- How do you stay updated with changes in financial regulations?

- Describe your experience with audit preparation and management

- What compliance frameworks have you implemented?

Strong candidates maintain relationships with professional organizations, regularly attend continuing education programs, and subscribe to regulatory updates. They should describe systematic approaches to implementing new requirements and ensuring ongoing compliance across their teams.

Regulatory Compliance Checklist:• Industry-specific regulation knowledge • Audit preparation and management experience

• Internal control system design • Documentation and record-keeping processes • Training and development programs for compliance • Relationship management with external auditors • Regulatory change impact assessment

Technical Expertise and Systems

Financial Software and Technology

Technology proficiency directly impacts a finance director's effectiveness and their team's productivity. Understanding their experience with financial systems reveals their ability to drive efficiency and accuracy improvements.

Technology assessment questions:

- What is your experience with financial software and systems?

- How have you approached digital transformation initiatives?

- Describe your experience with automation implementation

Candidates should demonstrate experience with enterprise resource planning systems, financial planning software, and business intelligence tools. They should articulate how technology investments have improved their team's capabilities and organizational decision-making processes.

The most valuable candidates understand that technology implementation requires change management skills and user adoption strategies. They should provide examples of successful system implementations, including challenges overcome and benefits achieved.

Financial Modeling and Analysis

Financial planning and analysis capabilities enable data-driven decision making throughout the organization. The finance director's modeling expertise directly impacts strategic planning quality and operational efficiency.

FP&A evaluation focus:

- Can you describe your experience with financial planning and analysis?

- What forecasting methodologies do you prefer and why?

- How do you approach scenario planning and sensitivity analysis?

Strong candidates demonstrate expertise in building robust financial models that support various business scenarios. They should explain how they validate model assumptions and ensure accuracy in their forecasting processes.

Technical Skills Assessment Tool:

| Skill Category | Basic Level | Advanced Level | Expert Level |

|---|---|---|---|

| Excel/Modeling | Formulas, charts | Pivot tables, VBA | Complex models, automation |

| ERP Systems | Data entry, reports | Configuration, workflow | Implementation, optimization |

| BI Tools | Dashboard viewing | Report creation | Advanced analytics, integration |

| Automation | Process documentation | Simple automation | AI/ML integration |

Cultural Fit and Future-Readiness Assessment

Adaptability in Changing Financial Landscapes

The finance function continues evolving rapidly, requiring directors who can navigate uncertainty while positioning their organizations for future success. This assessment area differentiates forward-thinking candidates from those focused solely on traditional financial management.

How do finance directors respond when economic conditions shift unexpectedly? Their adaptability determines whether your organization thrives or merely survives during challenging periods.

Future-readiness evaluation:

- How do you approach financial forecasting in uncertain economic conditions?

- What is your experience with ESG reporting and sustainability metrics?

- How do you stay current with emerging trends in finance?

Exceptional candidates demonstrate curiosity about emerging trends and proactive approaches to preparing their organizations for change. They should articulate how they've adapted processes during previous economic disruptions and show understanding of evolving stakeholder expectations.

The rise of environmental, social, and governance reporting creates new compliance requirements while offering opportunities for operational improvements. Candidates should demonstrate awareness of these trends and ability to integrate sustainability considerations into financial planning processes.

Innovation and Continuous Learning

Professional development assessment:

- How do you approach continuous learning in your finance career?

- Describe an innovation you've implemented in financial processes

- What industry publications or professional organizations do you engage with?

Strong candidates actively seek learning opportunities, participate in professional development programs, and maintain networks with other finance professionals. They should demonstrate intellectual curiosity and commitment to staying current with evolving best practices.

Innovation in finance often involves process improvements, technology adoption, or creative problem-solving approaches. Look for examples of candidates challenging traditional methods while maintaining accuracy and compliance standards.

Behavioral and Situational Questions

Problem-Solving Scenarios

Finance directors regularly encounter complex challenges requiring analytical thinking, collaborative problem-solving, and decisive leadership. Their approach to difficult situations reveals character and capability under pressure.

Scenario-based evaluation:

- Can you describe a time when you had to solve a complex financial challenge?

- How do you handle ethical dilemmas in finance?

- Describe a difficult financial decision you've made and its outcome

Candidates should provide detailed examples demonstrating structured problem-solving approaches. They should explain how they gathered information, considered alternatives, consulted stakeholders, and implemented solutions while monitoring results.

Ethical considerations play increasingly important roles in financial decision-making. Strong candidates articulate clear ethical frameworks and provide examples of choosing principle-based solutions even when facing pressure to compromise standards.

Performance Under Pressure

Pressure situation assessment:

- Describe a time when you had to present financial information under tight deadlines

- How do you manage competing priorities during busy periods?

- Give an example of leading through a financial crisis

The ability to maintain accuracy and judgment while working under pressure distinguishes exceptional finance directors. They should demonstrate time management skills, delegation capabilities, and communication effectiveness during stressful situations.

Behavioral Assessment Framework:• Problem identification and analysis • Solution development and evaluation • Stakeholder communication and buy-in • Implementation planning and execution • Results monitoring and adjustment • Learning integration for future situations

Questions Candidates Should Ask Back

Understanding Company Financial Health

Sophisticated finance director candidates will ask insightful questions about your organization's financial position and strategic direction. Their questions reveal their analytical thinking and genuine interest in contributing to organizational success.

Company assessment questions candidates might ask:

- What are the key performance indicators you use to measure success?

- What financial challenges is the organization currently facing?

- How has the company's financial performance trended over recent years?

Strong candidates demonstrate preparation by asking informed questions based on publicly available financial information. They should show interest in understanding both current performance and future growth strategies.

Their questions should reveal understanding of industry dynamics and competitive positioning. Look for candidates who ask about market opportunities, operational challenges, and resource allocation priorities.

Role Expectations and Growth

Career development inquiry areas:

- How do you define success for this finance director position?

- What professional development opportunities are available?

- How does this role contribute to organizational strategic planning?

Candidates asking about success metrics demonstrate results-oriented thinking and desire for clear performance expectations. They should inquire about resources available for achieving objectives and support provided for professional growth.

The best candidates ask about long-term career progression opportunities and ways to expand their contributions to organizational success. They should demonstrate ambition balanced with commitment to current role responsibilities.

Interview Best Practices for Hiring Managers

Creating Effective Question Sequences

Successful finance director interviews require careful planning to assess both technical competencies and cultural fit. The sequence and structure of questions significantly impact the quality of information gathered.

Interview flow optimization:

- Begin with open-ended questions to encourage detailed responses

- Follow technical questions with behavioral examples

- Allow time for candidate questions and discussion

Start interviews with broad questions allowing candidates to demonstrate communication skills and thought processes. Transition to specific technical areas while maintaining conversational flow that encourages detailed responses.

The most effective interviews feel like professional discussions rather than interrogations. Create environments where candidates feel comfortable sharing challenges and failures alongside successes, providing more complete pictures of their capabilities.

Avoiding Common Interview Pitfalls

Interview improvement strategies:

- Prepare standardized questions for fair candidate comparison

- Avoid leading questions that suggest desired answers

- Focus on past performance rather than hypothetical situations

Consistency in questioning enables fair comparisons between candidates while ensuring comprehensive evaluation of critical competencies. Document responses systematically to support objective decision-making processes.

Best Practice Implementation Guide:• Develop competency-based question banks • Create scoring rubrics for objective evaluation • Train interview panel members on bias recognition • Establish clear decision-making criteria • Provide timely feedback to candidates • Continuously improve interview processes based on hiring outcomes

Bias can significantly impact hiring decisions, making structured evaluation processes essential for identifying the strongest candidates. Regular training helps interview teams recognize unconscious biases and focus on job-relevant qualifications.

The candidate experience during interviews reflects organizational culture and influences top candidates' interest in joining your team. Professional, well-organized interview processes demonstrate respect for candidates' time and create positive impressions regardless of hiring outcomes.