What is Financial BPO?

Financial business process outsourcing represents a strategic approach where organizations delegate their finance and accounting functions to specialized external providers. Rather than managing these operations internally, companies partner with experienced vendors who handle everything from accounts payable to tax reporting, collections management, and payroll processing.

• Your resume analyzed for free, opportunities delivered

The finance industry increasingly recognizes that outsourcing isn't simply about cost reduction anymore. It's about gaining access to expertise, technology, and scalability that many organizations struggle to build independently. According to the SEC's guidance on investment advisers, proper oversight of outsourced functions is critical for regulatory compliance.

Understanding the Core of Financial BPO

At its foundation, financial BPO encompasses multiple layers of business processes. These include data processing, compliance management, regulatory reporting, and customer service activities related to financial operations. When you outsource these processes, you're tapping into the collective experience of providers who manage similar functions across numerous banking institutions and credit card companies daily.

The Federal Banking Agencies' interagency guidance emphasizes that financial institutions remain responsible for ensuring outsourced activities are performed in a safe and sound manner. En savoir plus sur les standards réglementaires américains.

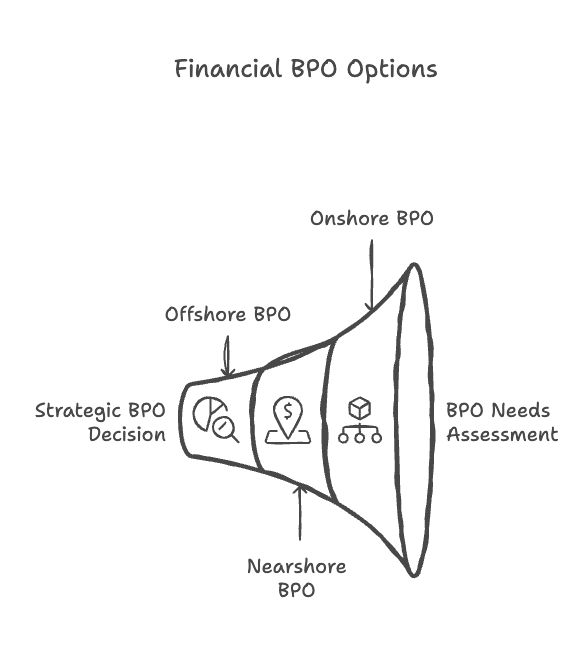

The Three Types of BPO in Financial Services

The industry recognizes three distinct categories of business process outsourcing that apply to finance operations:

- Onshore BPO - Service providers operate within your country, offering closer collaboration and similar regulatory environments

- Nearshore BPO - Vendors operate in neighboring regions, balancing cost efficiency with geographic proximity

- Offshore BPO - International providers deliver services from distant locations, typically maximizing cost advantages while maintaining quality standards

Each model offers different advantages depending on your organization's specific needs, compliance requirements, and growth strategy.

How Does Financial BPO Work in Practice?

The mechanics of financial BPO involve a structured handoff of responsibilities. Your organization defines which finance and accounting tasks require outsourcing—whether that's accounts payable automation, collections support, or full lifecycle finance operations management.

The BPO Implementation Process

Implementation typically follows this sequence. First, you meet with provider teams to assess your current operations and identify which processes would benefit most from outsourcing. Then, the service provider develops a tailored strategy based on your industry, compliance needs, and technology infrastructure.

Onboarding includes knowledge transfer, system integration, and training for the vendor's team. Most providers utilize shared services centers equipped with modern technology and experienced analysts trained in your specific industry—whether banking, lending, card services, or broader financial institutions. The CFPB's service provider guidance outlines expectations for managing these relationships effectively.

Technology's Role in Modern Financial Outsourcing

Today's financial BPO extends far beyond traditional manual processing. Automation, artificial intelligence, and robotic process automation (RPA) now handle routine accounting tasks with unprecedented speed and accuracy. This creates a seamless integration between your internal teams and outsourced operations, reducing processing time significantly while improving control and compliance standards.

Which Companies Are Financial BPOs For?

Not every organization needs to outsource finance operations. However, specific business scenarios make financial BPO particularly valuable.

Organizations That Benefit Most From Outsourcing

Mid-to-large enterprises managing complex accounting requirements often find outsourcing essential. Consider your situation: does your team struggle with capacity during peak periods? Do you lack specialized expertise in specific finance functions? Are you experiencing rapid growth that strains your internal resources?

Financial institutions, banking services providers, and credit card companies frequently partner with BPO vendors to handle customer service interactions, payment processing, and compliance-heavy activities. These organizations recognize that their core competency isn't managing back-office accounting—it's managing customer relationships and driving revenue.

Industries That Leverage Financial BPO Services

The lending sector extensively utilizes BPO for lifecycle management—from loan origination through collections. Banking institutions outsource customer service and regulatory reporting. Card services companies partner with vendors for transaction processing and customer support. Insurance companies rely on BPO for claims processing and policy administration.

| Industry Vertical | Common Outsourced Functions | Primary Benefits |

|---|---|---|

| Banking & Financial Services | Accounts payable, cash flow management, regulatory reporting | Cost reduction, compliance assurance, faster processing |

| Lending & Credit | Loan servicing, collections management, credit card operations | Specialized expertise, improved customer experience, reduced defaults |

| Insurance | Claims processing, accounting, customer support | Faster claim resolution, operational efficiency, focus on sales |

| Healthcare | Medical billing, accounts receivable, payment processing | Revenue cycle improvement, regulatory compliance, reduced bad debt |

What Business Functions Are Most Commonly Outsourced?

Organizations don't necessarily outsource everything. They strategically select functions that provide maximum value when delegated to external providers. According to OCC guidance on third-party relationships, institutions must maintain appropriate oversight of all outsourced activities.

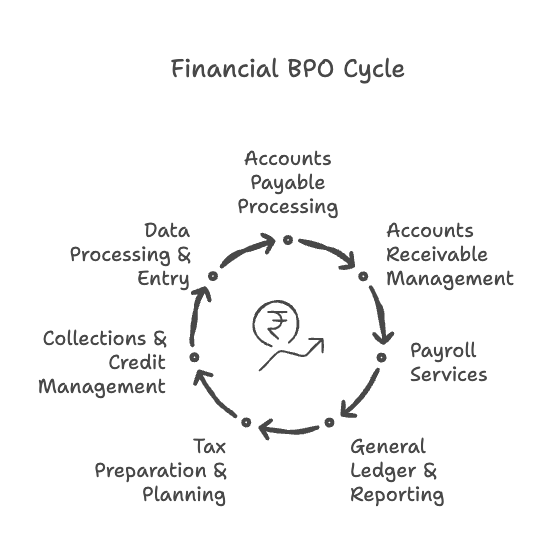

High-Priority Finance Functions for Outsourcing

- Accounts Payable Processing - Invoice management, vendor management, payment processing, and reconciliation

- Accounts Receivable Management - Invoice creation, customer service support, collections activities, and credit management

- Payroll Services - Wage calculation, tax withholding, compliance reporting, and employee support

- General Ledger & Reporting - Journal entries, financial statement preparation, and regulatory reporting

- Tax Preparation & Planning - Tax compliance, filing management, and strategic tax guidance

- Collections & Credit Management - Payment follow-up, dispute resolution, and customer interactions

- Data Processing & Entry - Transaction recording, database management, and information organization

Which Finance Tasks Are Best Suited for BPO?

The ideal candidates for outsourcing share common characteristics. They're repetitive, rules-based, and don't require deep strategic decision-making at senior levels. Accounts payable automation works beautifully for outsourcing because the process follows consistent patterns across most organizations. Collections support similarly benefits from outsourcing because vendors develop specialized expertise managing high-volume customer interactions.

The Strategic Advantages of Financial Outsourcing

Why are leading organizations moving toward financial BPO? The answer involves multiple interconnected benefits that extend beyond simple cost savings.

Cost Efficiency Through Shared Resources

When you utilize a shared services center operated by an experienced provider, you're pooling resources with other clients. This dramatically reduces overhead compared to maintaining a dedicated internal team. Your organization pays only for the processing volume you need, eliminating the burden of employing full-time staff during slow periods.

Access to Specialized Expertise

Top-tier BPO providers employ highly trained analysts with deep knowledge in specific industries and functions. These professionals stay current with regulatory changes, technology advances, and market innovations. Your organization gains access to this expertise without the expense of building it internally or the challenge of retaining specialized talent.

Enhanced Compliance and Control

Financial services operate under stringent regulatory frameworks. Compliant outsourcing partners maintain security certifications, undergo regular audits, and implement controls that often exceed what smaller organizations could establish independently. Providers with PCI Level 1 and SOC2 Type II certifications ensure your data receives maximum protection. En savoir plus sur les standards FDIC pour les fournisseurs de services technologiques.

Operational Agility and Scalability

Market conditions change rapidly. Growth initiatives demand faster onboarding and expanded capacity. Financial BPO providers scale operations quickly to match your needs. Whether you're experiencing rapid expansion, seasonal fluctuations, or strategic initiatives, outsourced services adjust seamlessly without disrupting your core operations.

Technology Integration in Financial BPO

Modern financial outsourcing extends far beyond traditional offshore processing. Today's solutions leverage automation, artificial intelligence, and integrated platforms.

How Technology is Transforming Finance Operations

Accounts payable automation software now processes invoices with minimal human intervention. Machine learning algorithms identify exceptions, flag discrepancies, and suggest optimal payment strategies. Robotic process automation handles routine data entry and reconciliation tasks with precision that surpasses manual efforts.

These technological advances don't eliminate the need for human expertise—they enhance it. Experienced analysts now focus on strategic activities, exception handling, and customer interactions rather than repetitive data processing. The result? Faster processing times, fewer errors, and more valuable contributions from your team.

Integration with Your Existing Systems

Leading financial BPO providers integrate seamlessly with your existing technology infrastructure. Whether you use enterprise resource planning systems, accounting software, or proprietary platforms, experienced vendors configure connections that enable smooth data flow and real-time visibility.

| Technology Component | Impact on Financial Operations | Measurable Outcomes |

|---|---|---|

| Automation & RPA | Reduces manual processing, improves speed and accuracy | 50-70% reduction in processing time, minimal errors |

| AI & Machine Learning | Identifies patterns, predicts issues, optimizes workflows | Faster exception resolution, improved forecasting accuracy |

| Cloud Platforms | Enables real-time access, improves collaboration and security | 24/7 availability, enhanced data protection, reduced infrastructure costs |

| Analytics & Reporting Tools | Provides deeper insights into financial operations | Better decision-making, strategic insights, regulatory compliance |

Overcoming Common Challenges in Financial Outsourcing

Organizations considering financial BPO frequently identify potential obstacles. Understanding these challenges and proven solutions removes uncertainty from the decision.

Security and Data Protection Concerns

Entrusting sensitive financial data to external vendors understandably raises security concerns. Reputable BPO providers address this through multiple layers of protection: encrypted data transmission, secure facilities, employee background checks, and continuous security monitoring. Compliance certifications like SOC2 Type II provide independent verification that security standards meet industry requirements.

Quality and Control Challenges

How do you ensure outsourced teams maintain your quality standards? The answer lies in establishing clear service level agreements (SLAs) that define expectations for accuracy, timeliness, and customer service. Regular audits, performance monitoring, and dedicated account management ensure vendors meet these commitments.

Possible Integration Issues

Moving processes to external providers creates temporary disruption. Experienced vendors minimize this through structured implementation planning, phased transitions, and comprehensive training. Your internal team remains engaged throughout, ensuring smooth handoffs and continuous improvement.

The Difference Between BPO and Traditional Call Centers

Many people confuse financial BPO with basic call center services. The distinction matters significantly when evaluating vendor capabilities.

Call centers focus primarily on inbound and outbound customer service interactions—answering questions, resolving issues, managing customer inquiries. While customer service certainly plays a role in financial BPO, the scope extends far deeper. Financial BPO encompasses complete lifecycle management of complex accounting processes, regulatory compliance, data management, and strategic insights.

A call center agent handles customer service activities. A financial BPO team member works across multiple functions—perhaps managing collections one moment, processing accounts payable the next, and generating compliance reports afterward. The expertise required differs substantially.

Future Trends in Financial Services Outsourcing

The financial BPO landscape continues evolving rapidly. Several trends are shaping the industry's future direction.

Emerging Priorities for Finance Organizations

Organizations increasingly demand that outsourcing partners not just handle routine tasks but drive strategic value. This means shifting from traditional BPO toward integrated solutions that combine outsourcing, technology implementation, and strategic consulting. Providers must now offer insights derived from data processing, help organizations navigate regulatory changes, and identify opportunities for operational improvement.

Many firms now recognize that BPO alone isn't sufficient. They're seeking partners who can deliver technology solutions, change management support, and strategic guidance alongside core processing services. This integrated approach creates more sustainable, scalable operations that adapt as your organization evolves.

The Role of Automation in Future Finance Operations

Robotic process automation and artificial intelligence will continue transforming finance operations. The trend moves toward intelligent automation that learns from historical data, predicts future scenarios, and continuously optimizes processes. Organizations that adopt these technologies through outsourced partners gain competitive advantages in speed, accuracy, and strategic decision-making.

Why Rely on Experienced Financial BPO Providers?

Not all outsourcing relationships deliver equal value. Choosing between providers requires understanding what differentiates leaders in the field.

Key Criteria for Selecting a Financial BPO Partner

Experience matters profoundly. Providers who've managed similar financial operations across multiple banking institutions, lending organizations, and credit card companies bring proven methodologies, trained teams, and established best practices. They've encountered the challenges you'll face and developed solutions that work.

Industry specialization creates additional value. A provider focused specifically on financial services understands regulatory requirements, compliance obligations, and industry-specific processes far better than generalist firms. They invest in staying current with regulatory changes, maintaining appropriate certifications, and developing specialized expertise.

Technology capabilities separate leading providers from basic service centers. Look for vendors who've invested in automation, cloud infrastructure, analytics platforms, and integration tools. These technological foundations enable faster processing, better insights, and seamless integration with your systems.

Getting Started With Financial BPO

Ready to explore how full-service AP automation and comprehensive financial outsourcing can transform your finance operations?

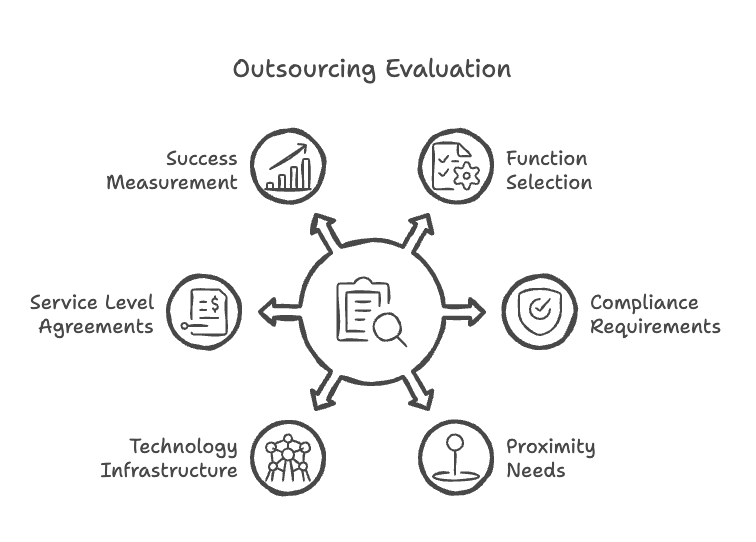

Key Questions to Address Before Outsourcing

- Which specific finance and accounting functions would benefit most from outsourcing?

- What are your compliance and regulatory requirements in your industry?

- How important is proximity—do you need onshore, nearshore, or offshore services?

- What technology infrastructure and integrations does your organization require?

- What service level agreements and performance metrics matter most to your business?

- How will you measure success and ROI from the outsourcing relationship?

Starting this evaluation process with clear objectives ensures you find a provider that matches your specific business needs and strategic vision for financial operations management.